Chapter 1Introduction

Chapter 2Don’t be embarrassed, nervous or afraid

Chapter 4What is the Procedure to File Bankruptcy?

Chapter 5When should I file bankruptcy?

Chapter 6What do I lose if I file bankruptcy?

Chapter 7What happens to my credit score if I file bankruptcy?

Chapter 8What can bankruptcy do for you?

Chapter 9What Does Bankruptcy Cost?

Chapter 10What is the Real Price Difference Between Bankruptcy Lawyers?

Chapter 11If I am Married, Can I File a Bankruptcy Without my Husband or Wife?

Chapter 12Will My Employer Find Out if I File Bankruptcy?

Chapter 13Does Chapter 7 or 13 Bankruptcy “Ruin My Credit?”

Chapter 14If I File Bankruptcy, Can I Leave Bills or Property or Transfers Off my Bankruptcy Petition?

Chapter 15Can I File Bankruptcy on Bills in Someone Else’s Name?

Chapter 16How Does Filing Bankruptcy Affect My Credit Union?

Chapter 17Can I file bankruptcy if I have co-signers?

Chapter 18What About My Car in Bankruptcy?

Chapter 19What Happens to My House in Bankruptcy?

Chapter 20When Will Creditors Stop Bothering Me?

Chapter 21Cross-Collateralization Agreements in Bankruptcy

Chapter 22Bankruptcy and Joint Accounts with Parents

Chapter 23When do I stop paying my creditors?

Chapter 24Gas, cable, electric and phone bill

Chapter 25Bankruptcy and Divorce, Alimony, & Child Support

Chapter 26What Bankruptcy won't solve

Chapter 27Chapter 13 Debt repayment Plans

Chapter 28Will I be able to get credit again?

Chapter 29Bill Consolidation Loans

Chapter 30Bill Consolidation Scams

Chapter 31Wage Assignments, Deductions and Levies

Chapter 32Student Loans

Chapter 33Can I get rid of Taxes

Chapter 34NSF Checks, Traffic & Parking Tickets

Chapter 35Surrendering Real Estate & Time Shares

Chapter 36Business Bankruptcy

Chapter 37Professional Persons

Chapter 38Do you ever "Not Get" a Discharge?

Chapter 39File bankruptcy for the debts of my deceased spouse or child?

This is an easy one. Because most stuff other than bankruptcy is fraudulent. That means someone somewhere, on the internet, or maybe in Russia, or maybe your own bank, wants your money, and will say anything to get it.

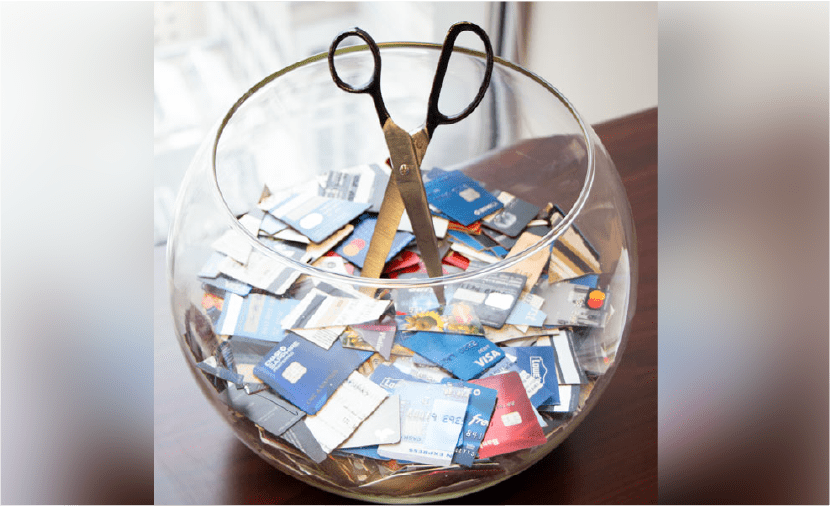

1. “bill consolidation” is usually a fraud scheme There is no way to “consolidate” all your bills into one lower payment you can afford, pay your vehicles and mortgage and tax debt first, and stop every single creditor from bothering you, adding late charges, or suing you. No way. None. Nada. Except for Chapter 13 bankruptcy. Oh, there’s that word again “bankruptcy.”

2. “Loan modification” Fraud schemes like “Legal Helpers Loan Modification” just stole people’s money and disappeared with millions. Banks usually string you along for months and lose your paperwork, making things worse. Then all they do is take your 30 year loan and turn it into a 40 year loan to “get” you a lower payment. Great, now you’ll die before you pay them off and they’ll get your house back after collection mostly interest payments.

3. “Credit Counseling” Possibly the worst fraud. Some of them pose as law firms. Some are “lawyers” who really should be in jail. Being a lawyer makes them try to take as much as the first year’s payments up front as fees”. They usually last a year before getting indicted and put out of business.

4. “Debt settlement” Definitely the worst. Run, do not walk, as fast as you can from these skunks. Legal Helpers Debt Resolution” and others stole $50 million or more and faded into the night. Their imitators are still around, and so are the lawyers involved. They only lost their law licenses for a couple years. Nice payday on your money!

All these schemes play on your guilty, embarrassment and confusion. They can’t stop late fees, repossessions, lawsuits, foreclosures, license suspension, or anything else. So, beware of “bill consolidation, mortgage modifiers, debt settlement and credit counseling”. We usually see folks who have paid $3,000 to $5,000 to bill consolidators, and have nothing to show to it, when they could have filed Chapter 7 or 13 and really solved their problems and gotten a true fresh start.

Bankruptcy is very predictable. Everything is in writing, and while there are a lot of stupid lawyers who do lose $3000 or $5000 of their client’s money in Chapter 7’s, and take Chapter 13 cases that fail quickly after they get paid, Geraci Law does not engage in shady practices. So why pay the same, and not get the name? Ask your friends and family, and even your boss at work. Chances are they’ll say, “talk to Geraci Law.”